CalPERS 6.7B Real Estate Bet in July

CalPERS makes big bet on real estate. It was announced today that in July the 300 billion dollar pension fund the largest in the US will not only be divesting its entire 4 billion hedge fund allocation but it has also committed 6.67 billion to real estate in the month of July. In one month this represents more than CalPERS has invested in real estate in the last 2 years combined.

Who and what did they invest in? They did a good job of spreading the investments across all regions and all asset classes.

- The largest single allocation was a co-investment joint venture of 1.3 billion to Institutional Multifamily Partners with GID Investment Funds for acquisitions and development of multi-family.

- Little over 1 billion was earmarked for Institutional Mall Investors and targeting dominate regional and superregional shopping centers.

- 985 million was co-invested with First Washington Realty a Bethesda Maryland based real estate investment group focusing on neighborhood shopping centers.

- 933 million was committed to large scale office and mixed use properties through Los Angeles based CommonWealth Partners by way of Fifth Street Properties (FSP).

- 412 million went to Institutional Core Multifamily Investors, a partnership with Invesco Real Estate targeting multi-family in the west and mid-west regions.

- GI Partners of Menlo park received $823 million for two existing joint ventures, TechCore and CalEast Solstice which focuses on technology related industrial properties.

- A follow-on commitment of 600 million with Institutional Logistics Partners, a partnership with Bentall Kennedy with a focus on dominate industrial properties.

- Rounding out the larger investments was a 200 million commitment to Pacific Multifamily Investors, a joint venture with Palo Alto, California based Pacific Urban Residential which will target class B multi-family properties.

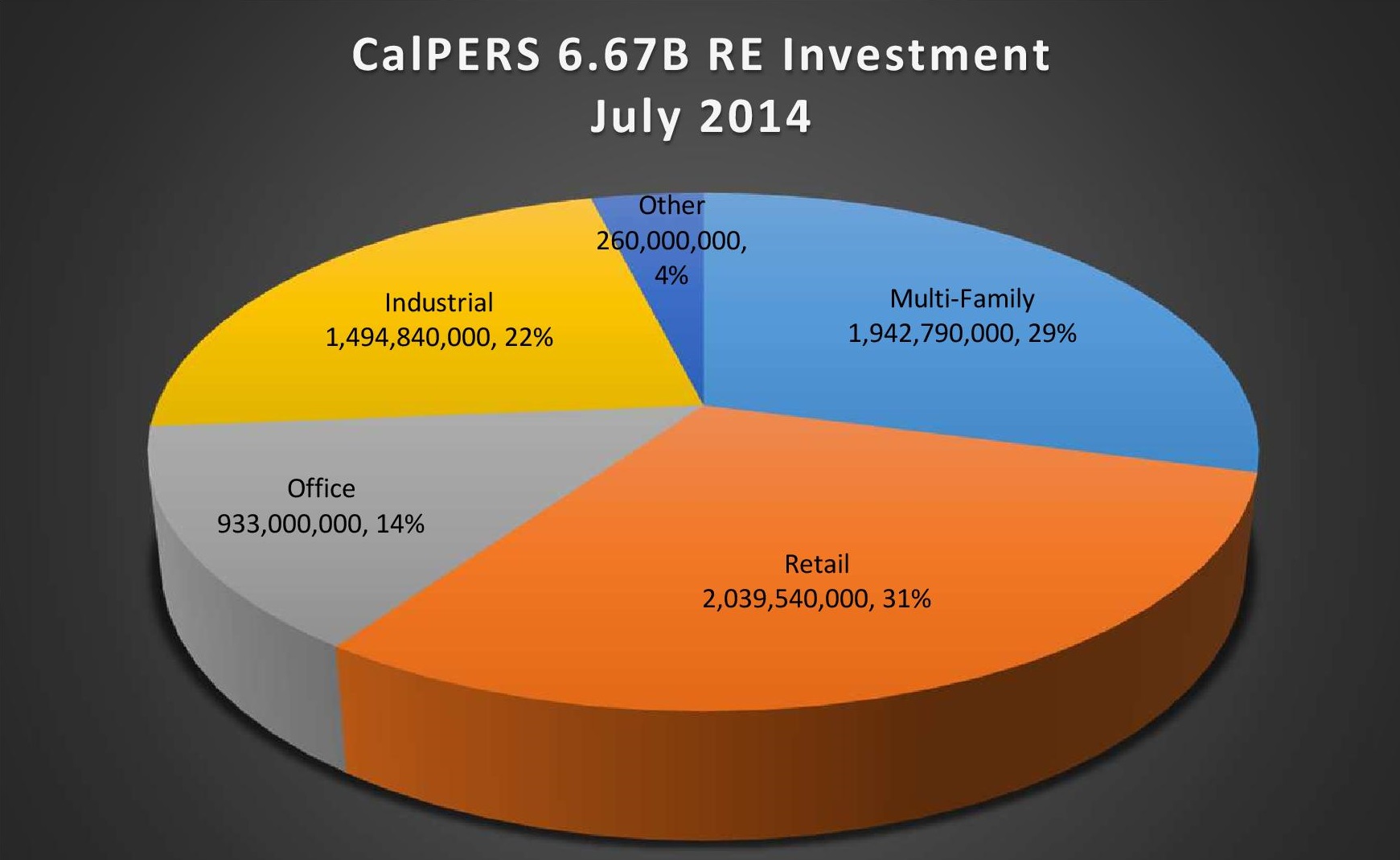

So the breakdown is a little over 2 billion to retail via malls and shopping centers, just under 2 billion to multi-family and 1.4 billion to industrial properties and a 900 million investment to office and mixed use properties plus a handful of other under 100 million dollar commitments

All in all this is in-line with what I am predicting as we will see more capital being allocated towards real estate for the remainder of this year and beginning of the next year. As investors and funds will look to be in some more secure positions with a basis in solid assets to hedge against an inflation risk. Plus with the stock market at or near record highs in both the Dow and S&P 500 it would be a good time to take some profits off the table.

God Bless and Profitable Investing,

Jake