I went to a dinner the other night put on by Up Capital Management with Thomas Rowley from Invesco as the keynote speaker. There were talks of emerging markets, baby boomers, how to fix social security and the market run up we have been experiencing.

We are in a crazy time if you ask me. With the DOW, S&P 500 at all-time highs and the record setting IPO of Alibaba (BABA) primed to hit the market. The FED announcing that it will continue its (ZIRP) zero interest rate policy for the “considerable time” as it winds down its bond buying QE program in October and gold making its seasonal bearish dive. As I am writing this I am watching BABA open at 93 now 94. Nearly a 35-40% jump out of the gate.

We have seen a 200% run up on the S&P 500 since 2009 with zero corrections. Anton Bayer of Up Capital said they have their finger hovering over the sell button. Which seems like the smartest response to this insane run up. Ride the wave while you can and then hop off as soon as it starts to correct.

The question is raised where do you put your money if we see a market correction or where do you invest if you missed out on the phenomenal market run up?

Eric Savell also of Up Capital has some solid suggestions of energy companies, which to me also makes sense given the shifting emphasis on being energy independent here in the US. But being a real estate guy I would consider real estate as an alternative investment to the stock market. I can’t seem to pull the trigger on investing into something at the record setting peaks and the looming possibility of a 40% market correction.

If you invested in real estate in 2006 or 2007 odds are even if you picked a great asset and bought it under value and locked it up with extremely low rates you still saw it lose a ton of value. Now if you rode out that cliff and happened to be in areas like San Francisco or Orange County then you might be back to even 7 to 8 years later. So to me that is why I have a hard time investing in the stock market at its peak high. Yes a company may be primed for growth be and a solid investment like Alibaba (BABA) but it could also be a victim to the overall market correction. To be honest that is outside of my wheelhouse, as I am not a stocks and bonds guy. I have taken some of those finance classes in college and have a general knowledge of them but what I have really studied for the last 15 years is real estate. So how I view the world is through the lens of what does this mean for real estate.

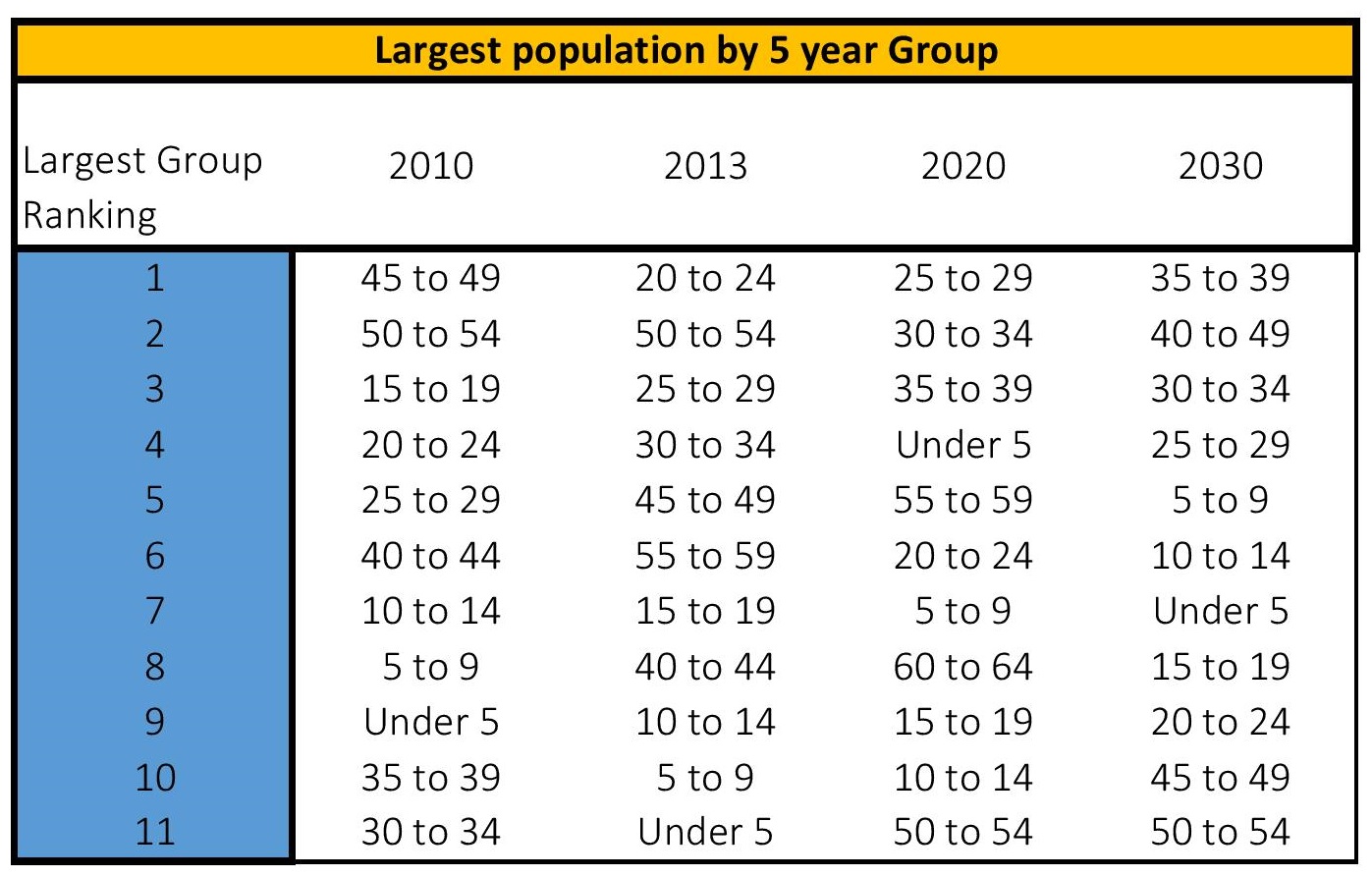

Besides just being biased towards real estate because I run a private equity fund that invest in real estate. I look into the deeper reasoning behind the scenes, the reasons why or why not invest into real estate if it is primed to be a safe and solid investment or not. This brings me back to the baby boomers, it has been wildly publicized about the baby boomers and how they are this huge market force. What has gone somewhat under the radar is that baby boomers are no longer the largest cohort group of people. Wait!? What!? When did that happen? Well in 2013 the 20 to 24 year old group ascended to the top of the list as the largest 5 year group of people and not only that, the baby boomers will continue to slide down the chart as we hit 2020.

What does this chart mean to real estate? What analysis can we correlate to these groups of people?

Well I will tell you since a large portion of my time is spent looking at deals and studying the data and economics as it relates to real estate. Plus if you saw my last post on CalPERS making a huge bet into real estate you would notice that nearly 2 billion of that committed capital was earmarked for multi-family residential (MFR) development and acquisitions.

Multi-family vacancies are at a national average of 4.2% with California markets at around 2.6-3% vacancy. This seems to be skewed way below other real estate classes with industrial vacancy at 8.2% and office vacancy at 15.1%.

Why would multi-family residential (MFR) vacancies be so low? Well it goes back to these population groups. If you are 20 to 24 typically you aren’t in a place to buy a house. Maybe you are fresh out of college and have a nice fat student loan debt to pay back (I’ll address student debt in a future blog for sure). But typically a 20 to 24 year old is more in a place to rent an apartment. Now add in the fact that the baby boomers are still a big group of the population as their population bandwidth is sizable. But we are seeing more and more baby boomers winding down their expenditures. As owning a house can be burdensome with upkeep and maintenance. Plus tell me who really wants to mow the lawn, or shovel snow? So they too are looking at multi-family residential as an option to simplify their life and reduce expenditures.

So to me this all correlates to the current trend of why the MFR market is red hot and will continue to be strong. Currently we see a pretty substantial increase in new multi-family projects breaking ground, but for the next several years I don’t see the high demand for multi-family being met. For a myriad of reasons as many of these projects were in the works years ago and just sidelined waiting for the market to come back. Now add into the fact that any new projects are very difficult to get off the drawing board to reality. Especially in California with issues of construction defect attorney’s breathing down your neck the moment you break ground and insurance companies refusing to insure multi-family builders. On top of city officials still on the crazy train with fees and lack of approvals. All of that adds up to a strong multi-family market with low vacancies for the foreseeable future. And why CalPERS committed 2 billion to multi-family in July.

But the caveat of that population data is the real story to me, and lends itself to some other underlying factors of a positive future for the real estate market.

Let's bring that chart up again and I'll clue you into what I am seeing.

Look at what happens in 2020 with the population. We have the 25 to 39 age groups as the 1st, 2nd and 3rd place groups of people and coming in 4th is the Under 5 group. That to me means there is going to be lots of new babies. Plus if you look at the normal expenditures in your lifetime they really start to ramp up at the age of 25 and peak between 30 and 45 and then start to taper off as you get into later stages of your career.

Well in 2020 (which by the way is pretty much just 5 years away) with more babies and now the largest 3 groups of people in their prime spending years. I see an increase of demand for SFR housing. It is nice to be in an apartment when you are 20 to 24 with your buddies but it’s a different story when you are 25 to 39 and are married and have kids.

Some might argue that this group of people doesn’t want the burden of owning a home or can’t afford it. For some of them I would agree, but there will also be a large portion of those groups that want to own homes. But we could also talk about the fact that as we make more money having an interest payment that we can write off and depreciate against is a very nice bonus. As we all know the tax burden doesn’t look like it will be decreasing anytime in the near future.

For those that don’t want to own I think there will be options as SFR rentals has started to show it has some legs to make itself a solid investment alternative to multi-family as it offers the enjoy ability of a house but without the maintenance burden or the risk of loss of value but also without the appreciation gains. Even though these people don’t want to own houses it doesn’t reduce the demand for housing. It just changes who owns the house.

The future of interest rates are unpredictable with Janet Yellen and the Fed holding true to the low interest rates I see affordability will remain for the time being, but if we see a spike in rates that could hurt the affordability of housing however I don’t see it reducing the demand for housing as in the next 5 years we will have the top 4 groups of people all in a position to want to be in SFR vs MFR. I just see the ownership of some of those houses becoming more institutional and people transitioning from multi-family with record low vacancies into SFR rentals or buying a SFR.

How do we make money on these analysis is we look at markets that are still under-valued and allow us to move into distressed assets ahead of that growth then add value and be primed to exit. Some might say an announcement of the location of a new 5 billion dollar factory would be a good place to be investing. ;)

God Bless and have a great weekend.

Jake