The question I am asked several times a week is where do you put your money now?

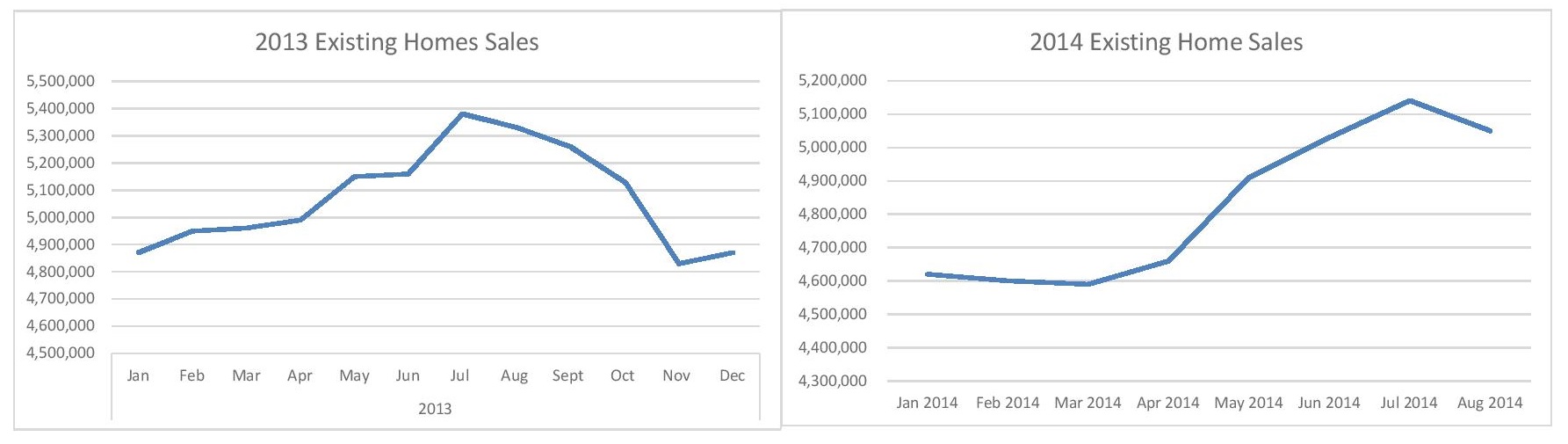

In the last several years, we have seen the stock market make record gains and at record highs, as well as the real estate market experienced massive amounts of distress but plenty of opportunity.

What do we do now? For the vast portion of people I have talked to the fear of the unknown has caused them to just stock pile cash in the bank and do nothing with it. This is essentially losing money if you factor in the nothing interest rates and inflation.

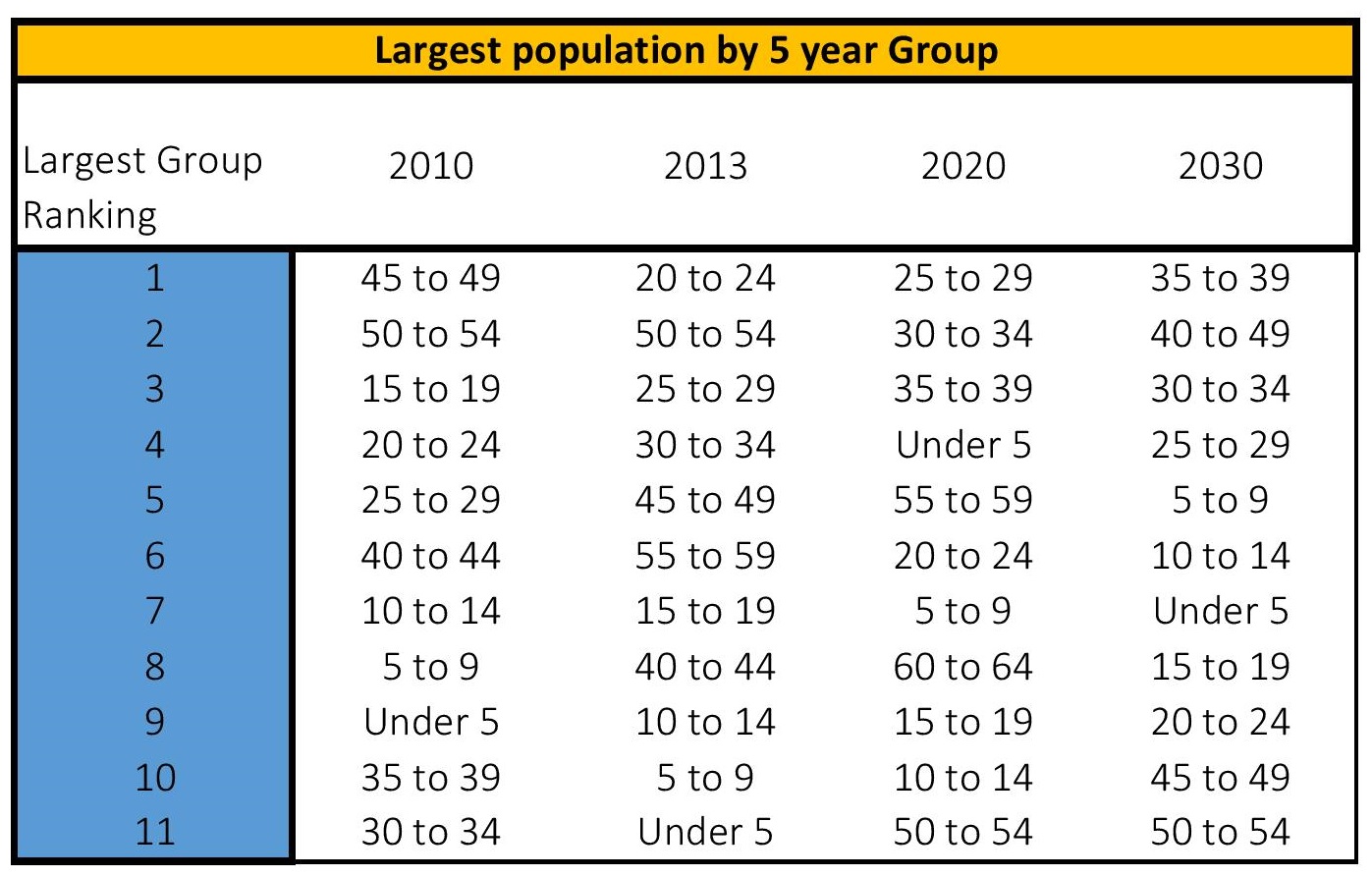

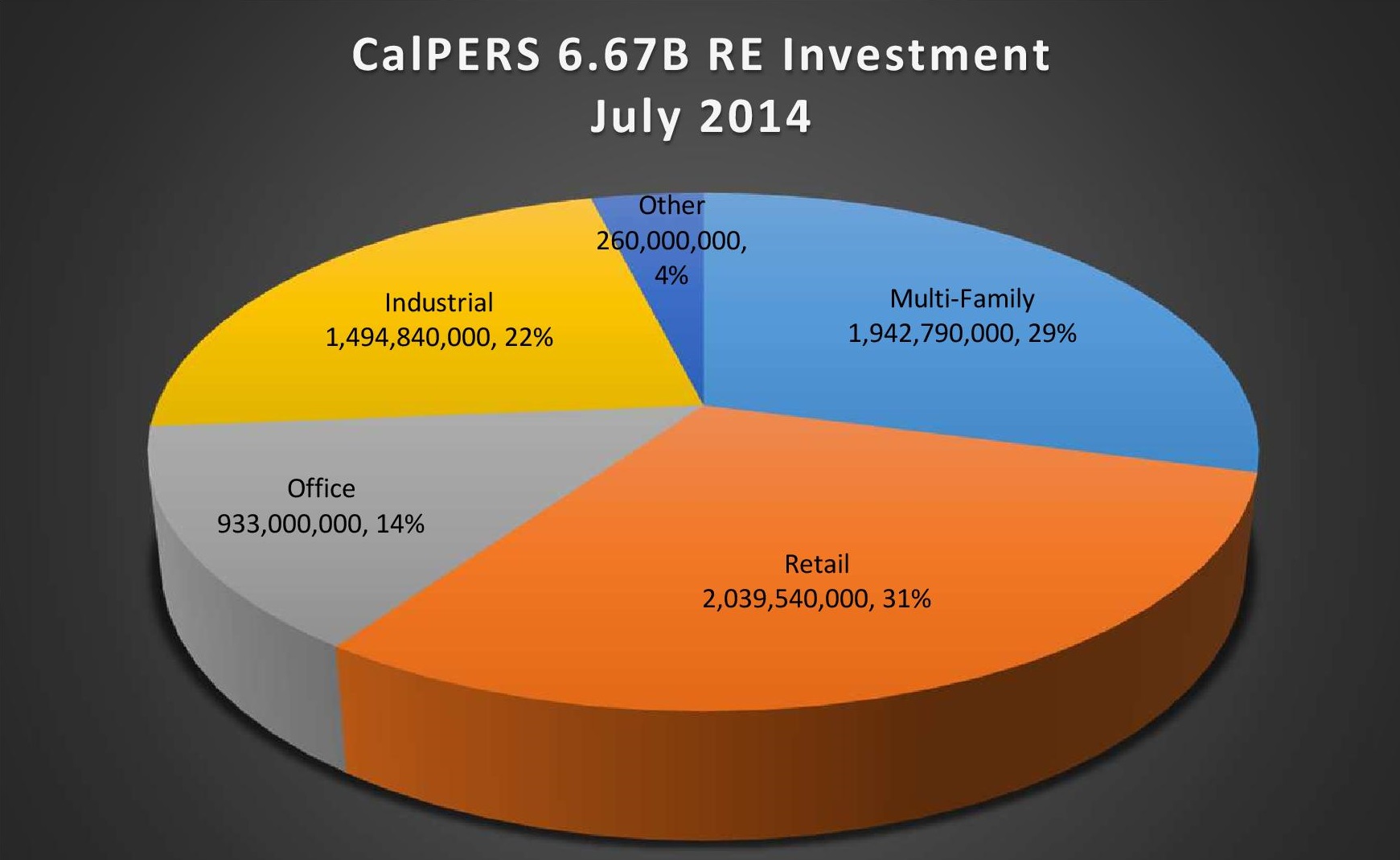

The question remains where do you put your money now? For me I feel there is a stock market correction coming down the pipeline. I am thinking with a stock market correction investors will take their last 3-4 years profits off the table and look to greener pastures. I am sure there is particular stocks and segments that will be just fine but stocks are not my cup of tea so I look to real estate. I feel a lot of the low hanging fruit has already been picked through (California, Vegas, Phoenix, Florida). As investors look for new places to place their money I feel real estate is the next logical choice as it is still down in parts of the country, that have good fundamental growth and affordability.

So for me the question is where is that place that has good affordability, good fundamental growth and enough inventory to support investor activity.

Also with the recent oil prices falling nearly in half since last June it is worth watching as this has both good and bad effects on particular markets. That either benefit for low cost of fuel, transportation, manufacturing or travel. Or the flip side of the coin those that depend on mineral rights, high cost oil wells like fracking that could be forced to close down and lay off workers.

- God Bless

Jake Harris